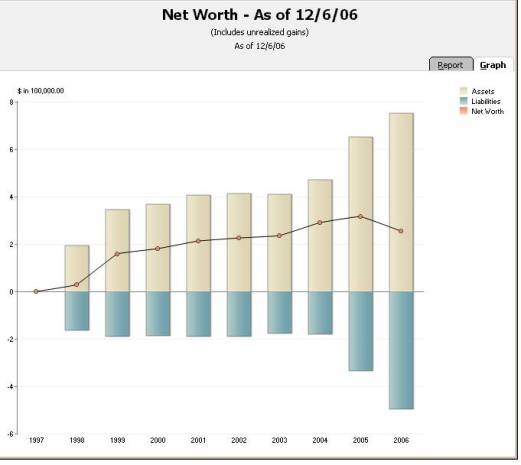

Net Worth

Posted by Paul on December 6, 2006

The Chart below summarizes the changes in my net worth over the last 7 years. My networth showed a decrease this year due to a payout from my 401k to my ex-wife. You can see that I had held my level of debt relatively steady for several years but it has mushroomed since my divorce. Part of that was legal debts but the two big changes have been due to purchases in real estate. After the divorce I lived in an apartment for a while but felt I was throwing away my money and since I didn’t have head of household status or mortgage interest deductions my taxes were very high.

So I bought a couple of real estate courses and after months of searching found a house that had been for sale for 6 months. The original owner had transferred and sold his house to a relocation company. It was the middle of winter and they had not received any offers on the house. So I made an outrageously low offer and they countered. We ended up about $33k below the price the relo company had paid for it. The appraiser still thought it was worth the relo price, so the broker was able to get me a mortgage without paying mortgage insurance. I borrowed a 10% downpayment from my 401k and so got into the house with nothing down and instant equity position.

The large changes in debt this year was due to the purchase of a rental property which I discussed here. You can see that I am cash poor but have some paper worth. Probably not as much as a person my age should have. My immediate problem is 4 teenagers who want to go to college. Only one may be scholarship material so, you can see why I am motivated to do something besides my job.

| cash | $1537 |

| RE Value | $585040 |

| Credit card debt | $7320 |

| Mortgage Liability | $489,037 |

| 401k | $167,280 |

| Net Worth | $256,004 |

Leave a comment